Health Insurance Best Coverage for Chronic Conditions

Health insurance policies with the best coverage for chronic conditions – Navigating the world of health insurance can be daunting, especially when dealing with chronic conditions. Understanding your options and finding a policy that provides comprehensive coverage is crucial for managing your health and finances. This article provides a detailed overview of health insurance policies and their coverage for chronic illnesses, helping you make informed decisions.

Understanding Chronic Conditions and Healthcare Costs

Chronic conditions, such as diabetes, heart disease, asthma, and arthritis, are long-lasting health problems that require ongoing medical care. These conditions often necessitate frequent doctor visits, prescription medications, specialized treatments, and hospitalizations, leading to significant healthcare expenses. Without adequate health insurance, the financial burden can be overwhelming.

The High Cost of Chronic Disease Management

The cumulative cost of managing a chronic condition can be substantial. This includes:

- Prescription drugs: Many chronic conditions require daily medication, which can be expensive even with insurance.

- Doctor visits: Regular check-ups and specialist appointments are essential for monitoring and managing chronic conditions.

- Specialized treatments: Conditions like diabetes might require insulin pumps or continuous glucose monitors, while heart disease might necessitate cardiac rehabilitation.

- Hospitalizations: Chronic conditions can lead to complications requiring hospitalization.

- Home healthcare: Some individuals with chronic conditions may require assistance with daily living tasks.

The cost of these services can quickly escalate, making comprehensive health insurance a necessity.

Types of Health Insurance and Chronic Condition Coverage

Several types of health insurance plans offer varying levels of coverage for chronic conditions. Understanding the differences is crucial in choosing the right plan for your needs.

1. HMO (Health Maintenance Organization)

HMOs typically require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists. While generally more affordable, HMOs may have limitations on out-of-network coverage, which could impact access to specialized care for chronic conditions.

2. PPO (Preferred Provider Organization)

PPOs offer more flexibility. You can see specialists without a referral and often have out-of-network coverage (though usually at a higher cost). PPOs tend to be more expensive than HMOs but offer greater choice and convenience, which can be particularly beneficial for individuals managing complex chronic conditions.

Source: ctfassets.net

3. EPO (Exclusive Provider Organization)

EPOs are similar to HMOs, requiring you to select a PCP within the network. However, unlike HMOs, EPOs generally don’t offer any coverage for out-of-network care, making them less flexible for those with chronic conditions needing specialized care outside the network.

4. POS (Point of Service)

POS plans combine elements of HMOs and PPOs. They typically require a PCP within the network, but allow you to see out-of-network providers at a higher cost. This offers a balance between cost and flexibility.

5. Medicare and Medicaid

Medicare and Medicaid are government-sponsored health insurance programs. Medicare is for individuals aged 65 and older or those with certain disabilities, while Medicaid provides coverage for low-income individuals and families. Both programs offer coverage for chronic conditions, but the specifics vary by state and plan.

Key Factors to Consider When Choosing a Plan

When selecting a health insurance plan for chronic conditions, consider the following:

- Premium costs: The monthly payment for your insurance.

- Deductible: The amount you pay out-of-pocket before your insurance coverage begins.

- Copay: The fixed amount you pay for each doctor’s visit.

- Coinsurance: Your share of the costs after meeting your deductible.

- Out-of-pocket maximum: The most you’ll pay out-of-pocket in a year.

- Network of doctors and specialists: Ensure your preferred doctors and specialists are in the plan’s network.

- Prescription drug coverage (formulary): Check if your necessary medications are covered and at what cost.

- Pre-existing condition coverage: The Affordable Care Act (ACA) prohibits insurers from denying coverage based on pre-existing conditions.

Finding the Best Coverage for Specific Chronic Conditions: Health Insurance Policies With The Best Coverage For Chronic Conditions

The ideal health insurance plan will depend on your specific chronic condition(s) and healthcare needs. For example:

Diabetes Management

Look for plans with good prescription drug coverage for insulin and other diabetes medications, as well as coverage for diabetes supplies like glucose monitors and test strips. Access to endocrinologists within the network is also crucial.

Heart Disease Management

Coverage for cardiac rehabilitation, specialized cardiac testing, and medications for heart conditions are essential. Access to cardiologists is paramount.

Asthma Management, Health insurance policies with the best coverage for chronic conditions

Ensure the plan covers inhalers, nebulizers, and other respiratory medications. Access to pulmonologists is important.

Frequently Asked Questions (FAQ)

- Q: Can I be denied coverage for a pre-existing condition? A: No, under the Affordable Care Act (ACA), health insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions.

- Q: What if my medication isn’t on the formulary? A: You may need to request a prior authorization from your insurance company to get coverage for medications not included in the formulary.

- Q: How can I find a plan that fits my needs? A: Use the HealthCare.gov website (for ACA plans) or consult with an insurance broker to compare plans and find the best fit for your chronic condition(s) and budget.

- Q: What is the role of a primary care physician (PCP)? A: Your PCP acts as your main point of contact for healthcare, coordinating your care and referring you to specialists when needed.

- Q: What is the difference between a deductible and an out-of-pocket maximum? A: Your deductible is the amount you pay before your insurance kicks in. Your out-of-pocket maximum is the most you will pay in a year, after which your insurance covers 100% of costs.

Resources

- Healthcare.gov (For ACA Marketplace plans)

- Centers for Medicare & Medicaid Services (CMS)

- National Institutes of Health (NIH)

Call to Action

Choosing the right health insurance plan is a critical step in managing your chronic condition. Take the time to research your options, compare plans, and consult with healthcare professionals and insurance brokers to find the best coverage for your individual needs. Don’t hesitate to ask questions and ensure you understand your policy’s benefits and limitations before enrolling.

Questions Often Asked

What are some common chronic conditions?

Common chronic conditions include diabetes, heart disease, asthma, arthritis, and mental health conditions.

Source: joinditto.in

How do I find out what my insurance covers?

Review your Summary of Benefits and Coverage (SBC) provided by your insurance company, or contact your insurer directly.

Can my insurance be denied due to a pre-existing condition?

In many countries, including the US under the Affordable Care Act, insurers cannot deny coverage based solely on pre-existing conditions.

What if my medication isn’t covered?

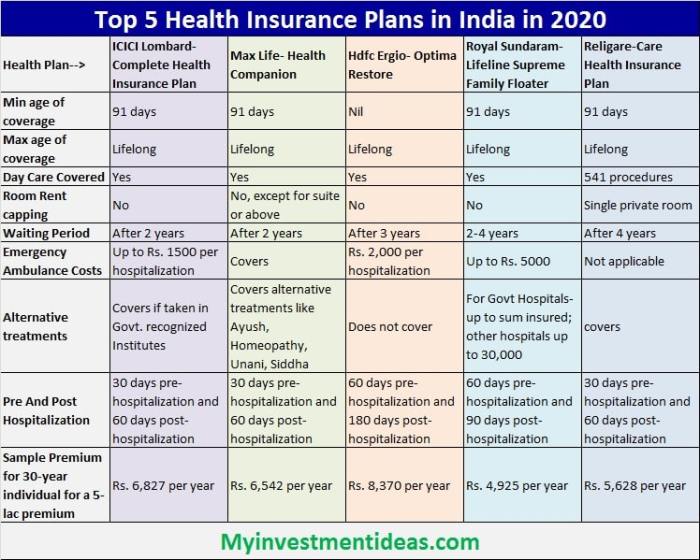

Source: myinvestmentideas.com

Explore options like appealing the decision, using a generic alternative, or contacting the pharmaceutical company for assistance programs.